by taxPRO Websites Staff | Mar 16, 2023 | Tax Tips and News

Taxpayers with foreign bank accounts who forgot to file an annual Report of Foreign Bank and Financial Accounts (FBAR) received some good news at the end of February. In Bittner v. United States, the Supreme Court ruled that the penalty for nonwillful failure to file...

by taxPRO Websites Staff | Mar 10, 2023 | Tax Tips and News

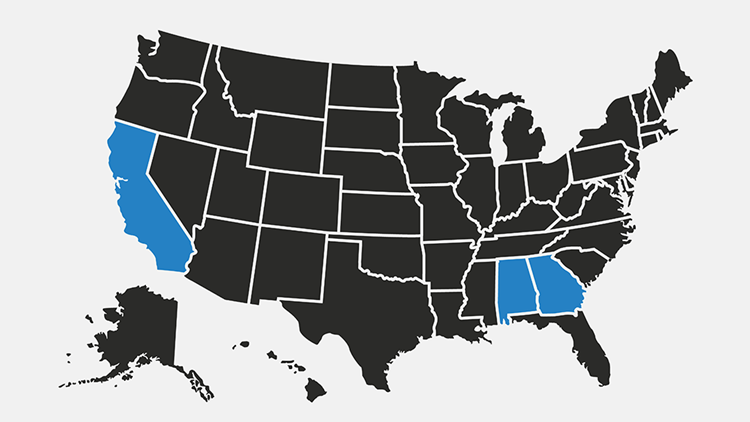

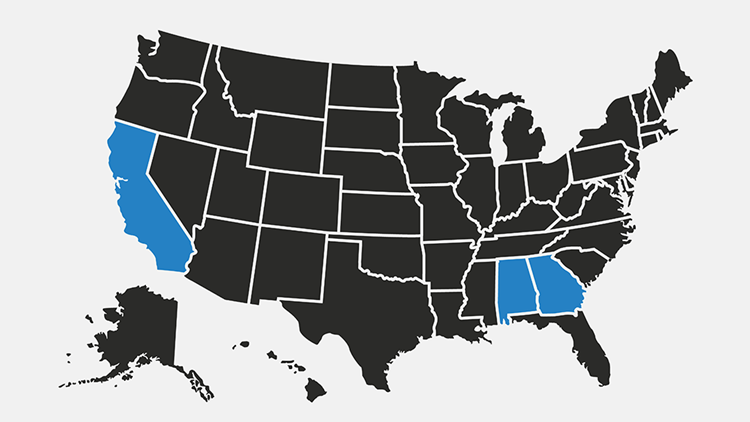

The Internal Revenue Service recently extended tax relief for disaster victims in Alabama, California, and Georgia. Individuals and businesses in these federally declared disaster areas now have until October 16, 2023, to meet several filing and payment...

by taxPRO Websites Staff | Mar 9, 2023 | Tax Tips and News

Taxpayers with foreign bank accounts who forgot to file an annual Report of Foreign Bank and Financial Accounts (FBAR) received some good news at the end of February. In Bittner v. United States, the Supreme Court held that the penalty for nonwillful failure to file...

by taxPRO Websites Staff | Feb 21, 2023 | Tax Tips and News

Filing an amended return used to mean completing a paper form, regardless of how taxpayers submitted the original return to the Internal Revenue Service. During the pandemic, paper-filed returns presented processing challenges that contributed to a historic backlog at...

by taxPRO Websites Staff | Feb 18, 2023 | Tax Tips and News

In 2022, millions of Americans received special state-issued payments designed to provide economic relief to residents struggling with financial burdens exacerbated by issues ranging from the pandemic to natural disasters. One week after urging recipients to postpone...

by taxPRO Websites Staff | Feb 15, 2023 | Tax Tips and News

As part of the Inflation Reduction Act of 2022, lawmakers made changes to the Clean Vehicle Credit that were meant to encourage the purchase of U.S.-made electric and fuel cell vehicles. Unfortunately, the criteria for qualifying vehicles has proven confusing for some...